Valvoline (VVV) - The Leader in DIFM Preventative Auto Maintenance

A quality business with a major buyback program underway

Welcome to The Investment Memo Substack! As this is my first post, there will be some things I need to work out about formatting and the like, so please bear with me. I’m really using this Substack to journal about companies that I find interesting but welcome feedback on where I can improve. As a reminder, these posts are meant to emphasize brevity and purposely differ from the deep dive format that is common on Substack / FinTwit so I recognize there are parts of the investment story I will not have captured.

With that being said, on to the post!

Business Overview

VVV traces its history back to the post-Civil War Pennsylvania oil rush that attracted prospectors and entrepreneurs hoping to profit off of the newly discovered “black gold”. One of these entrepreneurs was Dr. John Ellis, a physician who was looking to research properties of crude oil in hopes of some kind of medicinal application. Instead, Dr. Ellis discovered that by using steam heat instead of direct heat, crude oil could be used as a lubricant in mechanical applications. In 1866, Continuous Oil Refining Company was formed on the heels of this crude oil innovation and Dr. Ellis secured 4 patents to support his new product. The invention of the automobile followed by mass production of cars in the early 1900s proved to be a significant catalyst for the company’s growth. In 1950, VVV was acquired by Ashland Oil as part of its broader oil business and in the 1980s VVV acquired the Rapid Oil Change chain, marking its entry into the quick lube, DIFM retail services business. In more recent history, Ashland IPO’d Valvoline in 2016 comprised of both its product based lubricant business (Global Products) as well as its retail services oil change business (Retail Services), and in March 2023 VVV completed the sale of the former to Aramco for $2.25bn in net proceeds.

Segment Overview:

Retail Services: VVV owns and operates the second largest quick lube service chain by number of stores in the United States through its Valvoline Instant Oil Change (VIOC) brand across both company-operated and independent franchise locations. The Company also does business in Canada (third largest service chain in the country) under the Valvoline Great Canadian Oil Change brand and supports smaller NAM independent operators that do not fit the current franchise model under The Express Care platform.

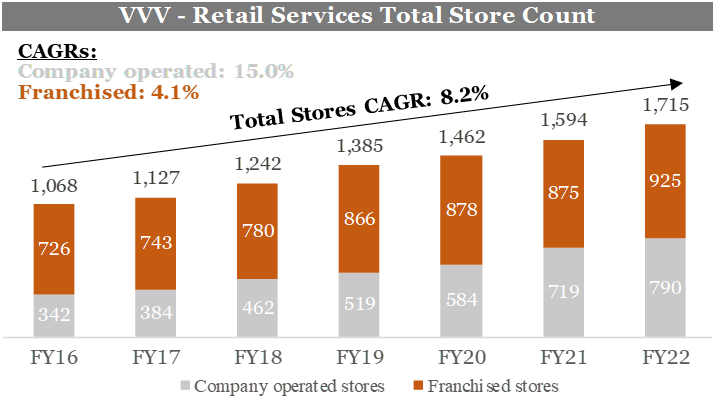

The Company currently operates 1,715 locations (the vast majority under the VIOC brand) with a ~54% franchise vs ~46% corporate owned split.

Industry and Competitive Landscape

The do it for me (DIFM) quick lube industry is a sector of the automotive services industry providing fluid exchange (motor oil, transmission fluid, coolant, etc.), parts replacement (battery, wiper blades, etc), and safety (tire rotation, safety check, etc.) offerings. Industry growth is supported by increasing vehicle age, count, and complexity as well as the gradual uptick in total miles driven. Furthermore, the market remains highly fragmented with a number of independent mom and pop operators as well as non-quick lube operators, such as dealerships, opening the door for M&A or market share gains. This is underscored by industry estimates of ~450mm DIFM oil changes performed annually, of which only ~100mm are served by quick lube operators. Finally, the industry is also in the early stages of a transition to providing services that better support hybrid electric vehicles (HEV) and battery electric vehicles (BEV) that do not require oil changes.

Competitive Landscape

1. Jiffy Lube: 2100+ stores (as of YE2021)

2. Valvoline: 1,715 stores (as of YE2022)

3. Pennzoil 10-Minute Oil Change: ~1000+ stores (as of YE2021)

4. Take 5 Oil Change: ~850+ stores (as of YE2022)

Take 5 Oil Change is a subsidiary of Driven Brands (DRVN), an automotive services company with a number of different brands and offerings, including maintenance; paint, collision & glass; and car washes

5. Grease Monkey: ~400 stores (as of YE2021)

VVV is the only publicly traded, pure play, quick lube operator.

Thesis Points

Reliable history of CSS growth creates attractive and defensive growth profile, while underpenetrated store base represents a significant runway for new units

VVV has reported positive CSS every single year since 2006 (4.4% in 2008 and 6.8% in 2009), displaying a level of performance that is consistent with the attractiveness of the automotive aftermarket industry more broadly. More recently, CSS have increased at about a HSD clip driven by both transaction and ticket, and management believes that this growth can continue in the 6-9% range through FY27.

Management is also targeting new unit expansion of 7-10% per year through FY27 for total topline growth of 14-16% over the next five years. As it relates to the underlying mix, the Company is looking to grow its capital-lite franchise operations (8-11%) faster than company owned units (6-9%) which should, over time, be margin accretive, enable faster growth, potentially benefit the trading multiple, and also generate greater FCF for share repurchases. Between both franchised and company owned operations, management believes its long-term whitespace opportunity is ~2x its current footprint and can grow from ~1,700 to ~3,500+ units. This growth is attributable to a fragmented market where management estimates that ~450mm DIFM oil changes are conducted each year, of which VVV captures ~23mm for a market share of just ~5%. Similarly, management notes that its store share and transaction share is >3.0x higher in its top markets vs fleet average and that only ~15% of US and Canadian households are within a 5 minute drive of a VVV location, further supporting increased store density.

Proceeds from Global Products sale will result in a massive, near-term return of capital to shareholders.

VVV is expecting to generate gross proceeds of $2.65bn and net proceeds of $2.25bn for its Global Products business, of which ~$600-650mm will be used to pay down 2030 bonds and make some minor reinvestments. Management has further outlined that their intentions are to use the remaining $1.6bn for share repurchases, representing ~27% of the fully diluted market cap. Importantly, a buyback of this size was approved by the board following FY 4Q22 earnings, and management expects that these repurchases will be swiftly executed over the next 18 months.

Growth in non-oil change revenue services (NOCR) helps augment incremental growth while preparing VVV for the EV transition

NOCR services include the following:

Parts Replacement: 12V Battery, Filters, Wiper Blades, Belts

Safety: Tire inflation, Tire rotation, Safety Check, Bulbs

Fluid Exchange: Transmission fluid, Differential fluid, Coolant

The Company also recently bought full control of a joint venture with Club Assist (a leading global supplier of automotive lead-acid and AGM batteries) for a company called VCA, a battery and battery testing equipment distributor. Although the strategy is not fully fleshed out, VCA is another part of VVV’s attempt to offer battery related services to both ICE and EVs

At mature stores (defined as those opened before 10/1/15), NOCR revenue per average ticket has grown at a 4.8% CAGR from $17.4 to $21.1 while overall non-oil change revenue and fees have grown 74% between FY20 through FY22. On the most recent earnings call, management broke down NOCR revenue growth between the bottom quartile (+22%) vs top quartile (+7.8%), highlighting nearly 3x faster growth at underperforming units that are now just starting to be properly optimized. Going forward, management expects NOCR to continue being a significant contributor to ticket growth, particularly as they close the gap between poor performing and best performing stores. Importantly, these services also bring with them strong incremental margins.

Servicing medium and heavy duty fleets represents logical extension of core

In more recent quarters, management has also started discussing potential growth avenues via increasing penetration and servicing of fleets, including light, medium, and heavy duty vehicles. Today, fleets represent ~10% of VVV’s business but come with an average ticket that is ~25% higher than the core business, driven by NOCR services. Management views the medium duty market size at $4bn and heavy duty at $11bn, opening up adjacent growth opportunities. Given existing ICE fleets show a propensity for higher NOCR sales, the Company also sees electric fleets as an area for growth, recently announcing a partnership with EV manufacturer Arrival. This approach of small bets and experimentation also suggests that management is acutely aware of the need to prepare for an EV future.

Historical Financials and Valuation

Bear View and Debate Points

Concerns around transition to EVs suggests that VVV’s terminal value is impaired and current valuation does not take this into account.

Industry volumes are largely stagnant / declining slightly as improving vehicle technology leads to fewer oil changes.

The underlying oil change service is largely commoditized and VVV lacks differentiation from competitors such as Jiffy Lube, Pennzoil 10-Minute Oil Change, Take 5, and Grease Monkey.

Input cost volatility via base oil.

Valuation at ~20x EBITDA and ~29x EPS already reflects best in class retail services multiples and captures upside from buyback program.

Initial Areas of Further Diligence

Ability to roughly double store count from current levels, in-line with management targets

Sustainability of CSS growth

Sustainability of price (both through mix shift to higher value products and pricce increases) in CSS growth algorithm.

For reference: at mature stores, oil change revenue per average ticket has CAGR’d at 5.2% between 2018-2022 with vehicles served per day (in mature stores) increasing at a 4.4% CAGR over the same time period.

Ability to transition from a company owned new unit model to franchise led.

Clarity around franchise unit economics.

Details around supply agreement with Aramco.

Customer retention efforts and how VVV can drive repeat business.

Differentiation in model, customer service, etc. that give VVV a competitive advantage or moat

Explanation for elevated working capital in FY21 and FY22 which was attributable to other assets and liabilities. We assume a step down / normalization in FY23 which is boosting discretionary UFCF and could be an incorrect assumption.

Management

Sam Mitchell - CEO (September 2016 - Present)

Sam Mitchell joined Valvoline in 1997 as director of marketing for Valvoline’s brand management group.

Mitchell was named vice president of marketing in 1999 and vice president and general manager of Valvoline’s DIY retail business in 2000.

He became president of Valvoline and vice president of Ashland in 2002.

In 2011, Mitchell was named senior vice president of Ashland, while retaining his responsibilities for Valvoline.

Mitchell was named chief executive officer and director of Valvoline in September 2016.

Ownership: 0.26% of CSO worth $14.8mm

Mary Meixelsperger - CFO: (June 2016 - Present)

Meixelsperger began her career in public accounting at Arthur Young and Co. before serving as the chief financial officer for two large, complex non-profit organizations. She also served as chief financial officer for Worldmark Group, a private equity firm.

From 2005 to 2014, she was chief financial officer, controller and treasurer at Shopko Stores.

Just prior to joining Valvoline, Meixelsperger served as senior vice president and chief financial officer of DSW Inc.

Mary Meixelsperger was named Valvoline's chief financial officer in June 2016.

Ownership: 0.06% of CSO worth $3.6mm.

Lori Flees - President, Retail Services (April 2022 - Present)

Flees began her career working at Intel and General Motors.

She then spent 17 years at Bain & Company Inc. doing a variety of work in consumer goods and services, engineering and construction, industrial manufacturing, and oil and gas.

Flees later joined Walmart as the head of Corporate Strategy, which included responsibility for global Mergers & Acquisitions. She was then promoted to Senior Vice President, Next Generation Retail & Principal, Store No 8 before running part of the retail operations as SVP and GMM for Sam’s Club Health & Wellness.

Flees joined Valvoline in April 2022 as president of Valvoline’s Retail Services business segment. In her role, she oversees Valvoline’s retail services business in North America. She has experience in M&A, corporate strategy, and performance improvement, including experience developing growth strategies for retailers with a combination of company-owned and franchised stores.

Ownership: N/A

Total insider ownership: 0.47% of CSO worth $26.6mm

Concluding Thoughts

VVV fits my criteria as both a quality business as well as an investment with special situations elements (recent sale of a lower quality business, cancelation of dividend, and large repurchase program). In this case, however, it seems that the market is largely already a believer in the story. Although VVV is trading at roughly ~17.5x my NTM EBITDA estimate, roughly in-line with peers, there is a large delta between EBITDA and FCF, attributable in large part to a working capital headwind that has amounted to ~10%+ of sales in each of the last 2 years. In both years this headwind was driven by changes in other assets and liabilities, with the 2022 10-K simply noting: “unfavorable changes in other assets and liabilities primarily due to cloud computing investments and the timing of certain prepayments.” In my projections above I've roughly assumed that this headwind reverts from ~10-12% of sales to 5%, in an attempt at a very blunt normalization. If I keep the impact from working capital steady, VVV goes from trading at ~30x to north of 40x FCF. As noted in the Initial Areas of Further Diligence section, this is somewhere I need to look into further.

I also want to better understand VVV’s exposure to the unpredictability of base oil prices, which creates some level of input cost volatility that should factor into its quality. During 2022, this volatility negatively impacted gross margins. Similarly, question marks around the EV transition should also factor into some kind of discount applied to the company’s terminal value / multiple paid.

Overall, I view VVV as currently a bit expensive but with a very understandable new store expansion approach and clear opportunity to take market share from both unfocused (dealerships) and subscale (mom and pop) peers. With the level of growth the Company is forecasting over the next 5-years and management’s push towards franchising, the significant buyback program could prove to be an attractive use of capital post the Global Products sale. I think VVV warrants a deeper look and plan on doing more work to stress test and find weakness in my hypothesis.

Really enjoyed this and I know we’ve chat about $VVV in the past. You pointed out that “store share and transaction share is >3.0x higher in its top markets” and that they are stealing share from Mom&Pop. Any reason for them to gain share in the future/what’s driving it? Assuming it’s a function of scale but want to get your perspective